Essential Retirement Planning Strategies for Central Government Employees

Retirement planning for Central Government employees has entered a transformative phase in 2025, marked by the introduction of the Unified Pension Scheme (UPS), enhanced gratuity limits, and evolving investment frameworks. A strategic approach to retirement requires understanding multiple benefit streams, optimizing tax advantages, and creating a financial roadmap that begins years before the actual retirement date.

Chapter 1: Understanding Your Pension Architecture

1.1 The Three Pension Frameworks

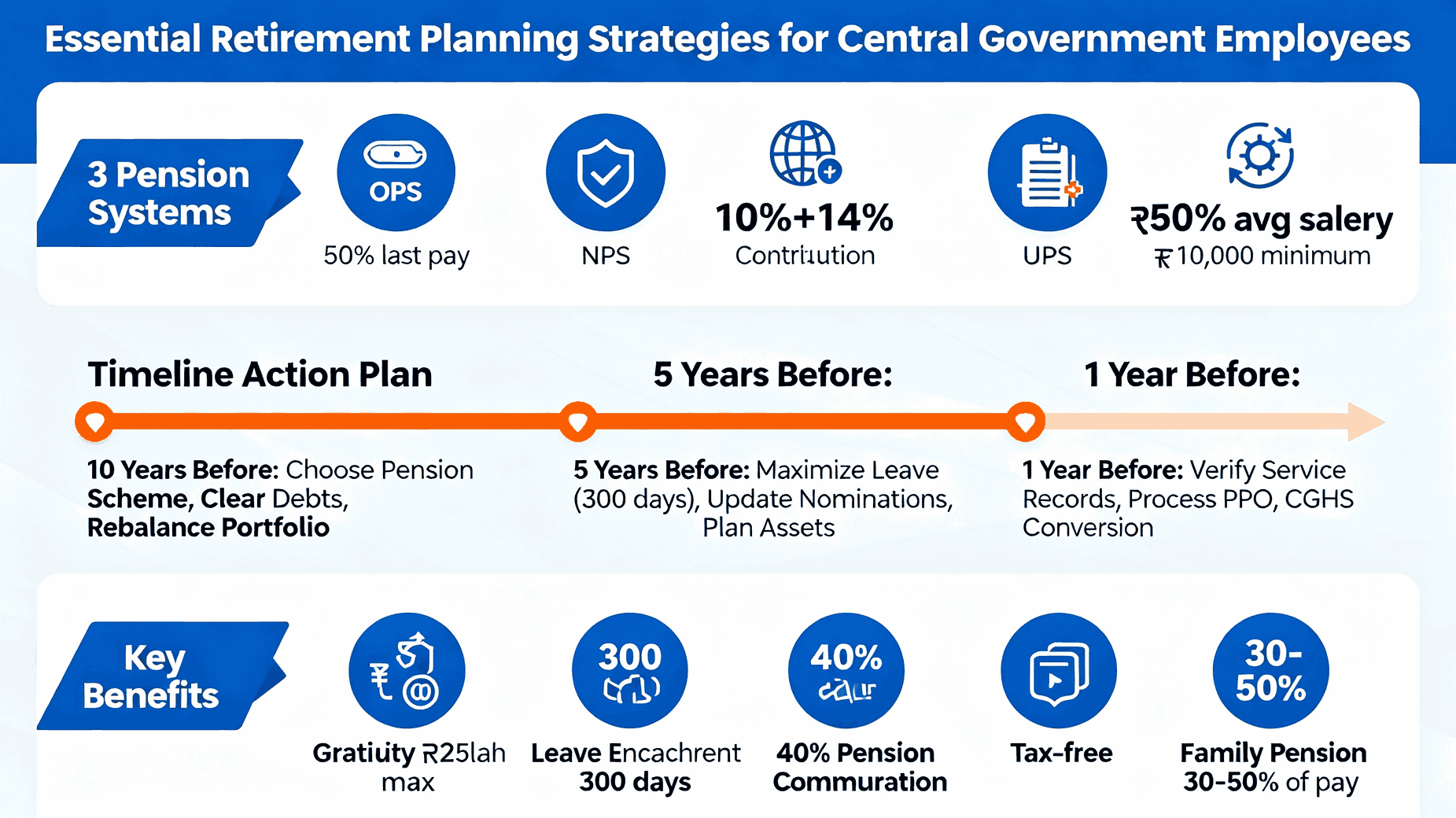

Central Government employees now navigate three distinct pension systems depending on their date of joining and recent scheme choices.

Old Pension Scheme (OPS): Applicable to employees who joined before January 1, 2004, OPS provides a defined benefit of 50% of the last drawn basic pay after 33 years of qualifying service, with a current minimum pension of ₹9,000 per month. This scheme requires no employee contribution and offers full indexation through Dearness Relief (DR) linked to inflation.

National Pension Scheme (NPS): Mandatory for employees joining on or after January 1, 2004, NPS operates as a defined contribution scheme where 10% of salary (Basic + DA) is deducted from employee salary with a matching 14% employer contribution. The retirement corpus is market-linked, requiring strategic asset allocation across equity, corporate bonds, and government securities.

Unified Pension Scheme (UPS): Launched in April 2025 as a hybrid option, UPS guarantees 50% of the average basic salary of the last 12 months for employees completing 25 years of service, with a minimum pension of ₹10,000 per month for those with at least 10 years of qualifying service. Employees opting for UPS receive a "one-time one-way" opportunity to switch, making this decision irreversible.

1.2 Strategic Investment Choices Under NPS/UPS

The Government of India approved Life Cycle 75 (LC75) and Balanced Life Cycle (BLC) investment options for Central Government employees under both NPS and UPS in November 2025, expanding flexibility in retirement corpus management. LC75 automatically reduces equity exposure as you approach retirement, maintaining 75% equity allocation until age 35, then gradually shifting to safer debt instruments. Understanding these asset allocation strategies 10-15 years before retirement significantly impacts final corpus accumulation.

Chapter 2: Maximizing Gratuity and Leave Encashment

2.1 Gratuity Optimization Strategy

With the gratuity ceiling enhanced to ₹25 lakh effective January 1, 2024, retirement gratuity is calculated at 1/4th of monthly emoluments (Basic Pay + DA) for each completed six-monthly period of qualifying service. For 33 years or more of service, the formula yields 16.5 times the emoluments, subject to the ₹25 lakh maximum.

Strategic Timing Consideration: Since gratuity calculation uses the Basic Pay and DA drawn on the date of retirement, employees approaching the 33-year threshold should evaluate retirement timing relative to DA increment announcements. A DA hike immediately before retirement can substantially increase gratuity amounts when not capped by the ₹25 lakh limit.

2.2 Leave Encashment Planning

Earned Leave encashment at retirement allows conversion of accumulated leave into cash payment, calculated on the pay drawn at retirement. Central Government employees can accumulate up to 300 days of Earned Leave, with encashment permitted for the entire balance. This benefit is fully taxable but represents a significant lump sum component of retirement proceeds.

Chapter 3: Commutation of Pension

3.1 The 40% Commutation Option

Central Government pensioners under OPS can commute up to 40% of their monthly pension into a lump sum payment. This irreversible decision converts future pension flow into immediate capital, with the commuted portion restored after 15 years without interest. The commutation factor depends on the retiree's age at the time of commutation, with younger retirees receiving higher multiples.

Tax Advantage: Commuted pension is fully exempt from income tax for government employees, making it an attractive option for those requiring immediate capital for debt clearance, property purchase, or investment diversification.

Strategic Evaluation: Employees should assess their immediate capital requirements, alternative investment returns, and life expectancy when deciding commutation percentage. Those with adequate corpus may prefer retaining full monthly pension flow, while others benefit from the lump sum for specific financial goals.

Chapter 4: Healthcare and Insurance Planning

4.1 Central Government Health Scheme (CGHS) Continuity

CGHS coverage continues post-retirement for all eligible employees and dependents, providing subsidized healthcare access through empaneled hospitals. However, pensioners must ensure timely conversion of their CGHS cards from service to pensioner category and understand the revised contribution rates applicable to different cities.

4.2 Supplementary Health Insurance

Despite CGHS benefits, retirees should consider supplementary health insurance policies purchased 5-10 years before retirement to avoid age-related premium escalations and pre-existing disease exclusions. Senior citizen health insurance policies with adequate coverage for critical illnesses, hospitalization, and outpatient treatment create a comprehensive healthcare safety net.

Chapter 5: Timeline-Based Action Plan

5.1 Ten Years Before Retirement (Age 50-52)

Pension Choice Finalization: For NPS employees, evaluate the UPS option thoroughly, considering guaranteed pension benefits versus potential NPS corpus accumulation based on market performance projections.

Debt Elimination Strategy: Prioritize clearing all high-interest debts, including personal loans and credit card outstanding. Housing loans may continue if interest rates are favorable and tax benefits are significant.

Investment Portfolio Rebalancing: Gradually shift from aggressive equity allocation toward balanced and debt-oriented instruments to protect accumulated corpus from market volatility.

5.2 Five Years Before Retirement (Age 55-57)

Leave Accumulation: Maximize Earned Leave accumulation to approach the 300-day ceiling, ensuring optimal encashment benefits.

Real Estate and Asset Planning: Complete any planned property acquisitions or renovations while regular income continues, avoiding post-retirement capital depletion.

Succession and Nomination Updates: Update all nomination details across PPF, NPS, insurance policies, bank accounts, and government records to ensure seamless benefit transfer.

5.3 One Year Before Retirement (Age 59)

The Department of Pension & Pensioners' Welfare now mandates preparation of retirement files 12-15 months before the retirement date, ensuring timely issuance of Pension Payment Orders (PPOs), gratuity, and other dues from the day of retirement. Employees must proactively engage with their administrative departments to verify:

- Complete service records and qualifying service calculations

- Final salary certificates and DA rates

- Bank account details for pension credit

- CGHS card conversion procedures

- Pension Payment Order processing status

5.4 Post-Retirement Financial Management

Lump Sum Deployment: Strategically allocate the combined corpus from gratuity, commuted pension (if applicable), leave encashment, and NPS withdrawals across fixed income instruments, equity mutual funds for inflation protection, and emergency liquidity reserves.

Pension Optimization: Ensure Dearness Relief (DR) is correctly applied to monthly pension, verify life certificate submission requirements (annually through digital life certificate or physical submission), and understand family pension provisions for spouse continuation.

Chapter 6: Tax Planning for Retirees

6.1 Understanding Exempt Income Streams

Government pensioners enjoy significant tax advantages: monthly pension income is fully taxable as "Income from Salaries," but gratuity up to ₹25 lakh, commuted pension (full amount), and leave encashment are completely exempt from tax. Structuring withdrawals and income streams to maximize these exemptions substantially reduces tax liability.

6.2 Section 80C and Health-Related Deductions

Post-retirement, continue utilizing Section 80C deductions through investments in PPF, Senior Citizens' Savings Scheme (SCSS), and National Savings Certificates. Senior citizens above 60 years can claim an additional ₹50,000 deduction under Section 80D for health insurance premiums, while those above 80 years enjoy enhanced medical expense deductions.

Chapter 7: Estate Planning and Legacy Management

7.1 Family Pension Provisions

Central Government family pension provides 30% of the last drawn basic pay (or 50% of pension for OPS pensioners) to the spouse upon the pensioner's death, ensuring financial security for dependents. Employees should clearly document family pension nominations and ensure spouses understand the claim procedures and documentation requirements.

7.2 Will Preparation and Asset Documentation

Prepare a comprehensive will detailing asset distribution, property ownership, investment account details, and insurance policy information. Maintaining a consolidated asset register accessible to family members prevents complications during inheritance transfer and ensures your financial legacy is efficiently managed.

This comprehensive strategy positions Central Government employees to transition into retirement with financial security, optimized benefits, and peace of mind, leveraging the evolving regulatory framework that now offers enhanced pension guarantees and improved benefit processing timelines.